MOVE Bank reduced rates on several variable and fixed home loan rates by up to 0.40% p.a. effective 1 February 2021 to ensure we offered members our best rates possible.

These cuts are in addition to previous reductions in November 2020 following the RBA’s decision to reduce the official cash rate and apply to both owner-occupied and investment loans.

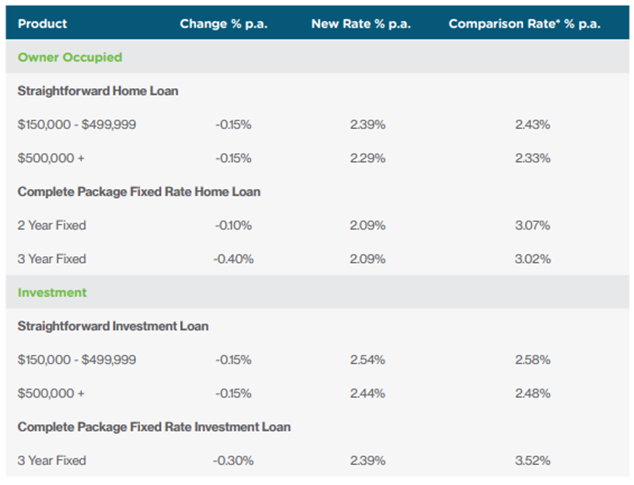

The following interest rates are now available for home and investment loans:

Deposit Changes

We have also made the difficult decision to reduce interest rates on our online savings accounts by up to 0.15% p.a.

As a mutual bank, we are committed to finding the right balance between delivering great value to our members, responding to changing market conditions and ensuring we operate sustainably.

The record low interest rate environment has made the decision to reduce deposit rates necessary.

Effective 1 February 2021:

- Express Saver and First Home Saver reduced by 0.10% p.a.

- Bonus Saver reduced by 0.15% p.a.

|

|

Enjoy a fixed rate return with a term depositLock in 1% p.a. for 24 months on balances from $5,000 to $500,000 (interest paid annually) with a MOVE Bank term deposit. To learn more about our term deposit options, visit movebank.com.au/termdeposit or call us on 1300 362 216.

|

*Comparison rate is based on a secured loan of $150,000 for a term of 25 years. WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate. Fees and charges apply. Rates quoted are correct as stated and are subject to change without further notice. All rates quoted are per annum. All applications are subject to MOVE Bank’s standard credit assessment and eligibility criteria.