Internet Banking FAQs

- Home Page

- Tools & Support

- FAQ

- Internet Banking FAQs

Update your details in 3 easy steps:

-

Log into Internet Banking

-

Select ‘My Preferences’

-

Click ‘Update Contact Details’

Not registered for Internet Banking? Call us on 1300 362 216 to get started.

If you’re registered for One Time Passwords, you can reset your password by following these simple steps:

- Go to Internet Banking and select ‘Forgot Password’

- Confirm your Member Number and Date of Birth

- Select ‘Next’ and an SMS will be sent to your registered mobile number

- Enter the code and follow the prompts to finalise

If you’re not registered for One Time Passwords, you’ll need to contact us during business hours on 1300 362 216 and we can reset your password.

Having trouble logging into Internet Banking? Try browsing in private mode, this will prompt any stored cookies on your computer.

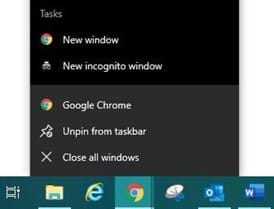

Chrome

-

On your desktop, click the Chrome logo

-

On the top right, click the three vertical ellipsis dots and then New Incognito Window

-

A new grey window will appear

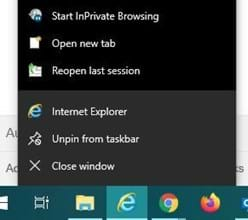

Internet Explorer

-

On your desktop, right click the Internet Explore logo

-

Then click Start InPrivate Browsing

-

A new window will appear

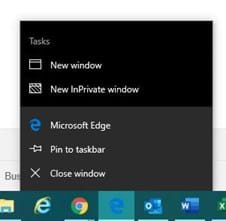

Microsoft Edge

-

On your desktop, click the Edge logo

-

On the top right, click the three horizontal ellipsis dots and then New InPrivate Window

-

A new grey window will appear

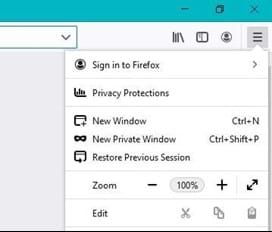

Mozilla Firefox

-

On your desktop, click the Mozilla Firefox logo

-

On the top right, click the three vertical ellipsis lines and then New Private Window

-

A new grey window will appear

Safari

-

On your desktop, click File at the top of your screen

-

Then click New Private Window

-

A new grey window will appear

Yes! However the joint account holder must be present when you open the new account. This is because we need to verify their identity before adding them to the account.

Open a joint account online in three easy steps:

-

Login to Internet Banking

-

Select the ‘Services’ menu

-

Click ‘New Savings Account’ and follow the prompts to finalise

You can avoid transactions fees when you borrow, save or invest with us. Learn more here

Only one dollar is required to open an account.

-

Internet Banking

-

Phone Banking

-

Mobile app

-

BPAY®

-

Visa

-

Cheque book

You can check your account balance using:

-

Internet banking

-

MOVE Bank App

-

Phone banking – call 1300 362 216 and select option 1

Contact the Member Care Centre on 1300 362 216 (view opening hours here)

-

Login to Internet Banking via the computer

-

Go to the 'MY PREFERENCES' menu option and select 'CHANGE PASSWORD'

-

Enter old password

-

Create new password

If you have One Time Passwords activated on your account, your external transfer limits are:

-

External transfers - $5,000

-

BPay - $10,000

-

Osko - $5,000

If you do NOT have On Time Passwords activated, your external transfer limits are:

-

External transfers - $2,000

-

BPay - $5,000

-

Osko - $2,000

-

Login to Internet Banking via the computer

-

Go to the 'SERVICES' menu option and select 'MANAGE ONE TIME PASSWORDS'

-

Select request

-

Follow prompts to finalise

BPAY is available via Internet Banking and Telephone Banking.

Regular Payees

- Login to Internet Banking and navigate to the ‘Payments’ tab in the top menu. From the drop-down menu select ‘My Payees’.

- Find the Payee you want to delete in the list and click the ‘Change’ button next to their details.

- Once you are looking at the details for the Payee, scroll to the bottom of the page and click the grey ‘Delete’ button.

BPay Payees

- Login to Internet Banking and navigate to the ‘Payments’ tab in the top menu. From the drop-down menu select ‘My BPAY Payees’.

- Find the BPay Payee you want to delete in the list and click the ‘Change’ button next to their details.

- Once you are looking at the details for the BPay Payee, scroll to the bottom of the page and click the grey ‘Delete’ button.

In the MOVE Bank App

- Login to the MOVE Bank App and tap the ‘Transfers’ button at the bottom of the screen.

- Tap the blue ‘My Payees’ button and then use the toggle at the top of the page to switch between regular and BPay Payees.

- Once you have found the Payee you want to delete, swipe left across their name and you will see a red ‘Delete’ button. Tap this to delete the Payee.

-

Log into Internet Banking

-

Go to “PAYMENTS” menu option

-

Select either “BPAY” or “Transfer Money”

-

Follow prompts to transfer funds

Please note that the amount available for redraw will be the amount your loan is in advance minus the value of one month’s repayments e.g. if repayment is monthly one repayment to be retained as an advance, if fortnightly three repayments will be retained as an advance.

-

Log into Internet Banking.

-

Go to the 'SERVICES' menu option and scroll down to 'ALERTS'.

-

Follow the prompts to add/edit/delete alerts.

Standard transfers are processed up to 3:45 pm any business day for the funds to be available at the receiving bank before close of business the following business day. Clearance times can vary depending on the receiving bank.

Any funds transferred during weekends or Public Holidays will be processed on the next business day, to enable funds to be received the following day.

NPP transfers are processed in real time and are available 24/7.

-

Log into Internet Banking.

-

Go to the 'PAYMENTS' menu option

-

Select 'FUTURE PAYMENTS'.

-

Follow the prompts to add/edit or remove a scheduled payment.

Members aged 12 years and above are eligible to join MOVE Bank as members or customers depending on their eligibility. They can open savings accounts and transaction accounts, and have the option to have a Visa Debit card attached to their transaction account. This account is opened in the child’s name and operated by them.

Visa transactions with retailers who do not do business with under 18’s will be blocked.

Children will need to verify their identity using either their passport or a Medicare Card

They should report their card as lost as soon as possible by calling MOVE Bank on 1300 362 216. To report a lost or stolen card outside business hours please call the Visa Lost / Stolen Card on 1800 621 199.

They can also lock their card using the MOVE Bank mobile app. This will prevent anyone else from using their card while it is lost.

Your child should sign the back of their card when they receive it.

Stay away from online stores that do not offer secure transactions. Look for the ‘s’ in the URL (https://www) and a closed padlock icon in the URL bar can identify if a store is secure.

Look out for free trials & subscriptions. Some websites will offer a free trial for a product (such as online games, or apps) and then start charging you a subscription.

Your PayID is information unique to you, like your phone number, email or ABN, that can be securely linked to your nominated bank account.

-

Login into the App

-

Under the Home tab select "Transfers"

-

Click PayID then Add New

-

Add details

-

Click confirm

-

Login into Internet Banking

-

Under My Preferences select "Manage PayID"

-

Select contact details and bank account

-

Click create

If you’re like most people, you probably find it difficult to remember details like your BSB and account numbers. A PayID makes things simple by securely linking the bank account of your choice to a registered mobile phone number, email address, or ABN.

-

Get Paid

Once you’re set up, you can simply share your PayID with anyone who needs to send you money.

-

Make Payments

When you use a PayID to make a payment you’ll automatically be shown the name of the person you are paying within your banking application. All you have to do is to confirm it’s the right person before you approve the payment.

You can register a PayID for any MOVE Bank savings or transaction account – including overdraft accounts.

No – you can only link ONE bank account to each individual mobile phone number or email address.

So if you have three accounts with and you’d like to set up a PayID for each of them, you’ll need to use a unique email address or mobile phone number for each account.

Yes. The “Manage PayID” section within Internet banking and the App will allow you to switch your PayID to a different MOVE Bank account, and request new PayIDs.

Yes. In the “Manage PayID” section you will have an option to make your PayID to “Transfer”.

Once you’ve done this, you’ll be able to login to your other financial institution’s internet banking portal and set up your new PayID using the same email or mobile phone number.

No, you don’t need a PayID to make an Osko payment. You can still use BSB and Account details as long as the other institution is registered for NPP.

PayID payments have the same level of security that protects your existing bank accounts.

NPP payments are made via:

Osko – NPP payment service

PayID – Your identity

For you as a member, the main benefits are…

Faster payments

Payments made using Osko (NPP payment service) will be in near real-time, with the funds available almost instantly. That means no more waiting 1-2 days for funds to clear.

No delays

NPP payments are available 24/7

You can forget your bank details

With the NPP you’ll be able to use your mobile number, email address or ABN as your PayID, which is used to identify your account instead of your bank details. So you won’t need to remember your BSB or account number anymore!

Please click here for more details on the NPP.

Why choose us?

BANKING & SAVINGS

CAR & PERSONAL LOANS

TOOLS & SUPPORT

CONTACT US

Privacy | Conditions of Use | Contact Us

Railways Credit Union Limited trading as MOVE Bank | ABN 91 087 651 090 | AFSL/Australian credit licence 234 536 | BSB 724 100 | Swift code WPACAU2S