If you’re looking to reduce your credit card debt in 2021, a balance transfer may be worth looking in to.

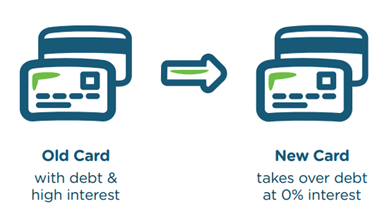

A balance transfer lets you move the balance owing on your existing credit card to another with a lower or 0% interest rate. Balance transfers are a great option if you’re paying a higher rate on your current credit card and want to save money on interest, freeing up your finances and helping you pay off your card.

Does it cost money to do a balance transfer?

Although we don’t charge any balance transfer fees, some lenders will- so keep this in mind when considering a balance transfer.

What types of balances can be transferred?

With MOVE Bank, you can transfer balances such as:

- Visa and MasterCard (all banks)

- Most store cards (e.g. David Jones and Myer)

Is there a minimum or maximum amount that I can apply for?

You can access up to 80% of your approved credit limit for balance transfer at the time of applying for the card. With our credit card, the minimum credit limit you can apply for is $1,000 and the maximum is $25,000.

How is my balance transferred?

The process of transferring your credit card to a new one is pretty simple.

When you apply online for a MOVE Bank credit card, you’ll be asked to supply details of your existing card. Once approved, we’ll simply payout and close your old card and roll it over to our Low Rate Credit Card.

|

|

Tidy up your finances in 2021 with a balance transferOur award-winning Low Rate Credit Card offers 6 months 0% interest on balance transfers and an ongoing low rate of 8.99%*. |

Low Rate Credit Card is offered, issued and administered by Railways Credit Union trading as MOVE Bank, Australian credit licence 234536. Terms and conditions apply and are available on our website. All credit card applications are subject to credit assessment and approval.

*The variable retail purchase rate is current as at 18/12/2020 and is subject to change. All rates are quoted per annum. For the current interest rate please visit movebank.com.au. Other fees and charges apply.

Balance transfer available to refinance debt from other lenders up to 80% of the approved limit. The 0% p.a. interest rate applies to balances transferred at point of application for a period of 6 months, commencing once the balance transfer has been processed. At the end of the balance transfer period, the interest rate on any outstanding transferred balance will revert to the variable annual percentage rate for purchases, currently 8.99% p.a.