When it comes to managing your home loan, an offset account can be a powerful tool if used correctly.

How does an offset account work?

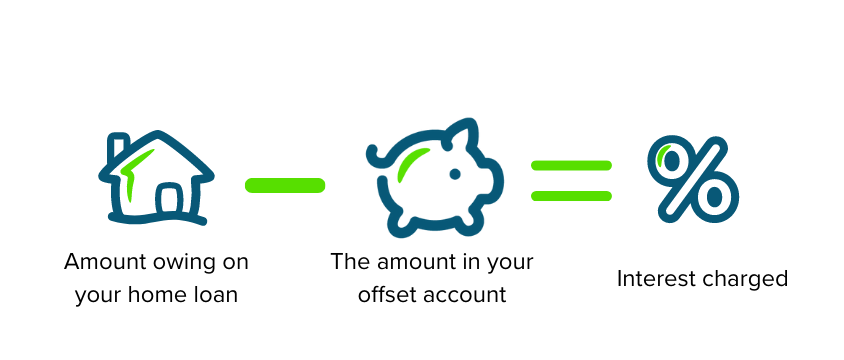

The concept is simple yet powerful. The balance in the offset account is subtracted from the outstanding mortgage balance, reducing the amount on which interest is calculated. As a result, members can effectively lower their interest expenses and potentially shorten the loan term.

Interest savings:

An offset account is a transaction account linked to your home loan. The balance in this account is offset against your outstanding mortgage balance, reducing the amount on which interest is charged. By maintaining a higher balance in the offset account, members can save on interest costs over the life of the loan.

Flexibility and accessibility:

Offset accounts provide members with easy access to their funds. It functions like a regular transaction account, allowing you to deposit and withdraw money as needed. This flexibility ensures that your funds are readily available for day-to-day expenses while still offsetting your home loan interest.

Reduced interest payments:

By utilising an offset account effectively, members can decrease the amount of interest they pay on their home loan. The interest is calculated on the outstanding loan balance minus the balance in the offset account. This means that the more money you keep in the offset account, the less interest you'll be charged.

Potential for faster loan repayment:

With an offset account, members can accelerate their home loan repayment. By maintaining a higher balance in the offset account, the interest savings can be substantial, enabling you to pay off your loan sooner than the original loan term.

Potential Tax advantages:

the interest earned in a regular savings account is generally taxable. However, the interest saved through an offset account is not considered income, providing potential tax advantages for members. This can be particularly beneficial for individuals in higher tax brackets.

Easy money management:

An offset account can be a valuable tool for members looking to manage their finances effectively. It allows you to pool your income, savings, and expenses in a single account. By consolidating your funds, you can better monitor your financial position, reduce interest expenses, and potentially pay off your loan faster.

Remember, it's important to consult with a financial advisor or an accountant to determine if an offset account is suitable for your specific circumstances

and financial goals.

To learn more about our home loan products that include an offset account, visit movebank.com.au/home-loans or speak to one our lending specialists

by calling us on 1300 362 216 or visiting movebank.com.au/contact.

This blog post is for general information purposes only and is not intended as financial or professional advice. It does not have regard to the financial situation or needs of any reader and must not be relied upon as financial product or other professional advice. You should seek your own independent financial, legal and taxation advice before making any decision about any action in relation to the material in this article.