The Bank of Mum and Dad is now one of Australia’s largest lenders. Housing prices have boomed nationwide since the start of the pandemic, meaning many parents and grandparents are keen to assist their children in making that often difficult first step onto the property ladder. But what is the Bank of Mum and Dad?

The phrase can generally mean two things. The traditional view is of parents providing their children financial support. For a house purchase, this would be the gift of some or all the funds of a deposit.

While many parents would love to be able to do this, the reality is that this is not always viable, and even if it is, may compromise the parents' own financial security as they head towards retirement.

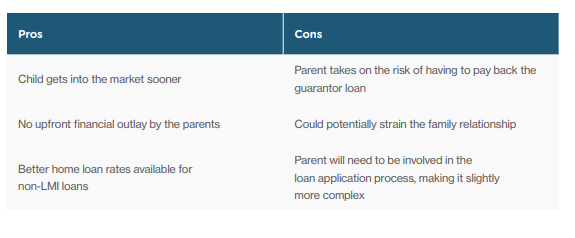

The second view, is of parents providing equity in their property to help their child(ren) get onto the property ladder sooner. This is known as a family guarantee loan. While there are financial

risks to be aware of, this option is often more readily available and potentially less of a burden on the parents.

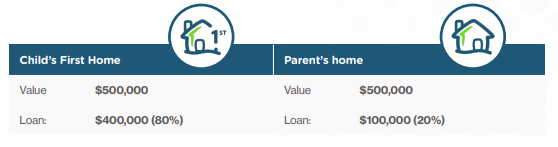

When you take out a home loan, the bank will require you to have at least some portion of equity in the property. Normally the minimum contribution is 5% of the property value to start the conversation, and 20%+ to avoid Lender’s Mortgage Insurance (LMI). With a family guarantee loan, the child(ren) can take out an 80% lend against their first home and borrow the rest of the funds against their parents’ property. No (often dreaded) LMI required, and no need to save a large deposit. Under this structure, parents don’t need to gift any funds yet can enable their child to borrow the full amount to buy a house, through utilizing the value in the family home. The parents are guarantors on the smaller loan and the larger loan is in their child’s name.

While this is a fantastic way to help their children get onto the property ladder, there are some important details to know. As the guarantor, they are placing their home as security against the child paying that (smaller) loan back. Should the debt go bad, the parents' risk having to take on the loan themselves to protect their property. If a rental property is used for the guarantor mortgage, the risk may be

considered significantly less, but if it is the family home, there is more at stake. If you would like to know more about family guarantee loans, and whether they might work in your own circumstances, please contact one of our lending specialists on 1300 362 216 or submit an enquiry form via our website. Our lending specialists would love to assist.

This blog post is for general information purposes only and is not intended as financial or professional advice. It does not have regard to the financial situation or needs of any reader and must not be relied upon as financial product or other professional advice. You should seek your own independent financial, legal and taxation advice before making any decision about any action in relation to the material in this article.