From 11 August 2020, members who have registered for One Time Passwords will no longer receive an SMS One Time Password when logging in to internet banking.

Instead, you’ll only need a One Time Password when you complete certain actions, including:

-

Adding a new payee or updating an existing one

-

Making payments to non-saved payees

-

Term deposit maintenance

-

Changing your password

-

Updating your address or contact details

This change will make it easier to access and view your account details, while adding an extra layer of security that can prevent fraudsters from being able to access or transfer funds out of your account.

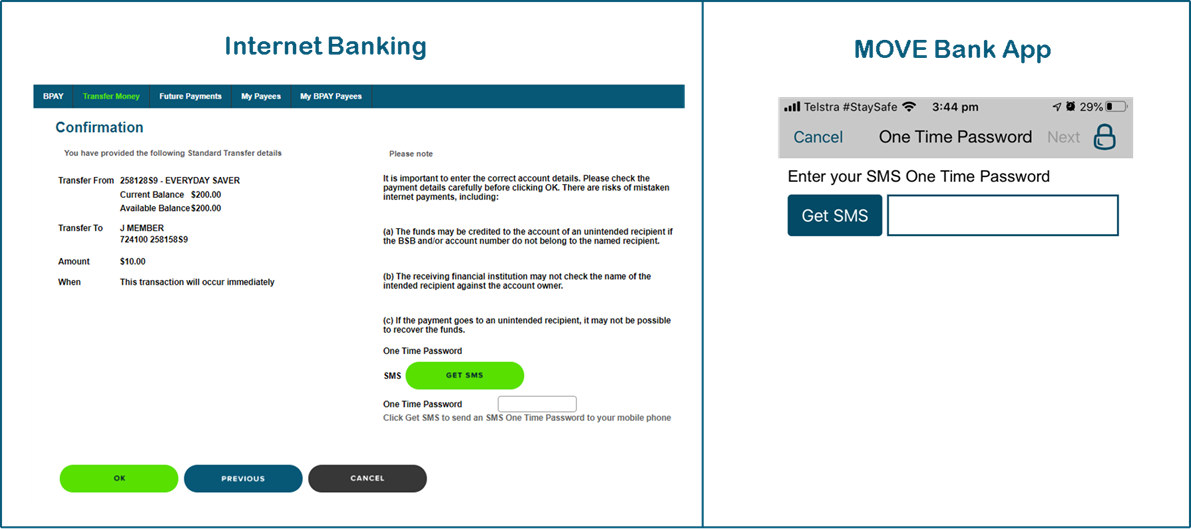

When you go to complete any of these actions you will need to click the "Get SMS" button to generate your One Time Password. The images below are examples of what this will look like in internet banking and the App:

What if I’m using the App?

If you are registered for One Time Passwords you can simply login to the app as you normally would using your pattern or PIN. You’ll only need a One Time Password when you add a new payee or update an existing one.

Daily Transfer Limits

Your daily transfer limits will remain the same.

For members with One Time Passwords, your external transfer limits are:

-

External transfers - $5,000

-

BPay - $10,000

-

Osko - $5,000

If you do NOT have On Time Passwords activated, your external transfer limits are:

-

External transfers - $2,000

-

BPay - $5,000

-

Osko - $2,000

Questions

If you have any questions about this change please don’t hesitate to contact us on 1300 362 216 during business hours or email us at info@movebank.com.au

For more information about how One Time Passwords help protect your accounts online please visit: https://movebank.com.au/one-time-passwords