As part of our commitment to protecting your accounts online, we are implementing increased security controls that will require all members to use One Time Passwords when performing certain actions in internet banking and the MOVE Bank App.

These changes will be rolled out to members in stages from early September, and we will contact you directly via email and SMS to let you know when you can expect this change to take effect.

How do One Time Passwords protect me?

One Time Passwords add an extra level of security to your online banking by using a two-step verification process.

This means once you’ve successfully logged into your account, you’ll also be asked to enter a unique code when you perform any of the following actions:

- Adding a new payee or updating an existing one

- Making payments to non-saved payees

- Term deposit maintenance

- Changing your password

- Updating your address or contact details

This second verification provides an additional layer of security that reduces the risk of fraudsters being able to access or transfer funds out of your account.

How do they work?

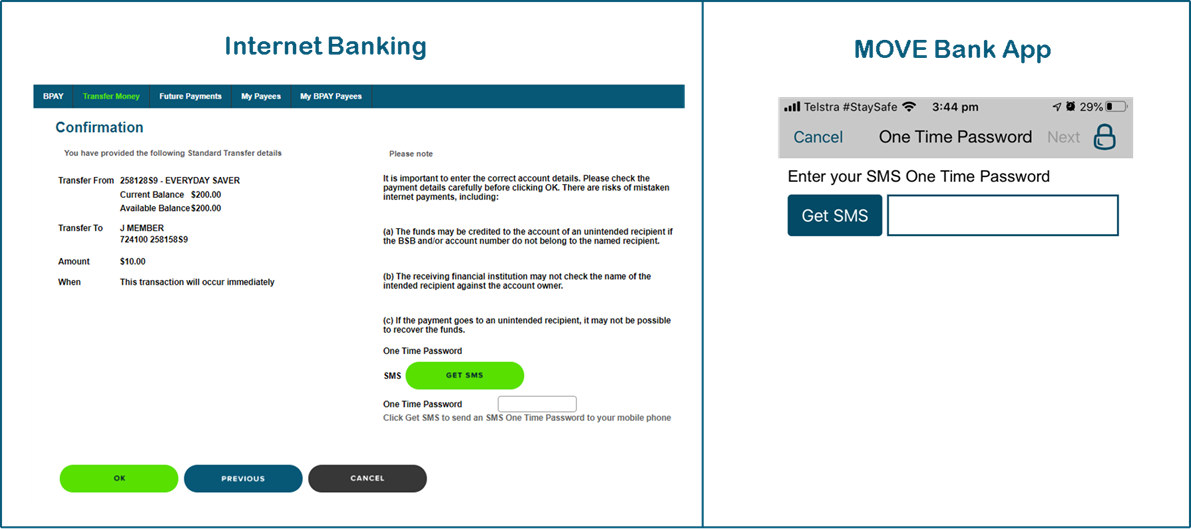

When you go to complete any of the actions listed above you will need to click the "Get SMS" button to generate your One Time Password (see image below).

An SMS with the unique code is then automatically sent to your nominated mobile.

Simply enter the code in the space provided and click the “OK” button to proceed.

Daily Transfer Limits

The extra layer of security provided by One Time Passwords means that once the change is effective you’ll have access to increased daily transfer limits:

- External transfers - $5,000

- BPay - $10,000

- Osko - $5,000

Questions

If you have any questions or concerns about this change please don’t hesitate to contact us on 1300 362 216 during business hours or email us at info@movebank.com.au.

You can also find out more about One Time Passwords by viewing our frequently asked questions here