Decommissioning of Phone Banking

- Home Page

- Tools & Support

- Support

- Decommissioning of Phone Banking

Why is MOVE Bank removing its Phone Banking service?

Our Phone Banking provider has notified us that our automated system is approaching its end of life. Unfortunately, there are no viable options available to replace this offering, so as a result we have made the difficult decision to decommission telephone banking on 24 March 2025.

What does this mean for you?

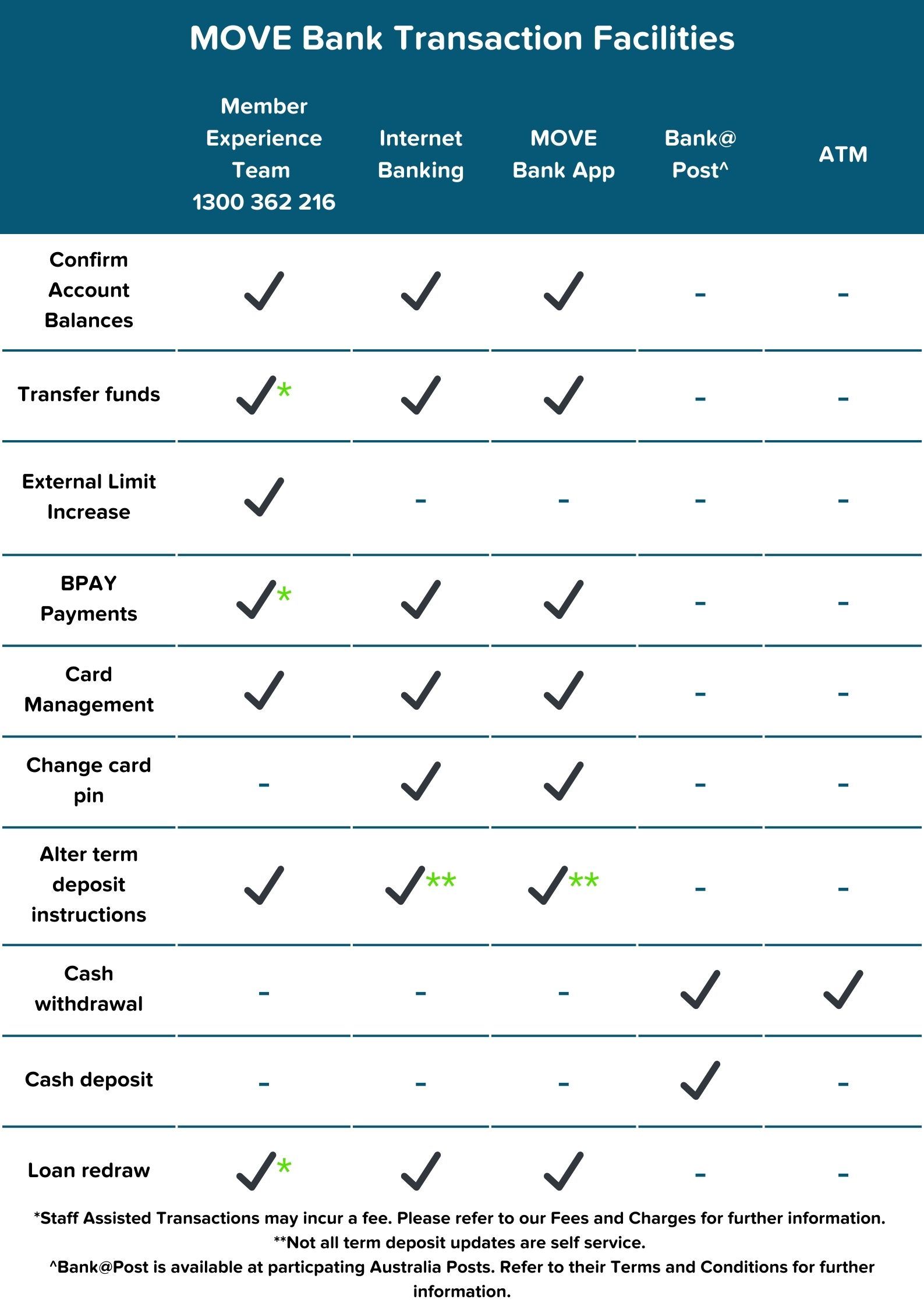

You can continue managing your accounts via the below channels.

Most of our members preferred banking method is Internet Banking or the MOVE Bank App. Our Internet Banking platform and MOVE Bank app offer a more user-friendly experience, with additional features to support a broader range of banking activities. Both Internet Banking and the MOVE Bank app also offer enhanced authentication and security features to help protect against unauthorised access.

To support you in this transition, we have created some resources to assist you in using Internet Banking. They can be found on our Internet Banking Hub.

Internet Banking

Internet banking lets you manage your money online 24/7, from your desktop, mobile or tablet device.

-

Transfer funds to a MOVE Bank account or another financial institution

-

Pay bills via BPAY®

-

Create a PayID and make instant payments using Osko by BPAY

-

View your online statements

For more information about Internet Banking visit movebank.com.au/internetbanking

How do I register for Internet Banking?

If you are not registered for Internet Banking, please give our Member Experience team a call to assist you on 1300 362 216 during business hours.

Internet Banking Hub

Download the MOVE Bank App

The MOVE Bank App helps you stay on top of your finances – anywhere, anytime. Developed for iPhone and Android phones, it has never been easier to check your account balance, make payments or transfer money on the go.

Bank with MOVE at Australia Post

Looking to deposit or withdraw money?

MOVE Bank has partnered with Australia Post's Bank@Post network to offer MOVE members access to deposit and withdrawal services at the 3,400+ (including more than 1,800 in rural and remote locations) Post Offices around Australia.

Find a participating Australia Post

SMS and Email Alerts

Register for alerts to stay informed about your account activity. Alerts provide real-time notifications for account balances, transaction activity, and more. Alerts can be set up within Internet Banking. Alternatively, our Member Experience team can assist you over the phone. Don't forget to make sure your mobile number and email address are up to date!

Decommissioning of Phone Banking FAQ's

This decision has been made due to the discontinuation of vendor support for the technology. Unfortunately, there are no other viable replacements for this service.

Our Internet Banking platform and MOVE Bank app offer a more user-friendly experience, with additional features to support a broader range of banking activities. Both Internet Banking and the MOVE Bank app also offer enhanced authentication and security features to better protect against unauthorised access.

We recognise that this change may affect members in various ways. Our Member Experience Team is dedicated to supporting our members through the transition. Our Internet Banking Hub features various tutorials on how to use this service. Alerts can also be set up to provide you with relevant account notifications.

Alerts work by providing an SMS and/or an email update at nominated times. Alerts can be set up within Internet Banking. Alternatively, the Member Experience team can assist in setting them up.

Alert types:

- Savings account balance is outside the nominated range

You can select a nominated amount, and you will be alerted when the balance either falls below or exceeds this amount.

- Loan or overdraft account balance is outside the nominated range

You can select a nominated amount, and you will be alerted when the balance either falls below or exceeds this amount.

- A credit or deposit more than the nominated amount

You can select a deposit amount, and you will be alerted when any deposit over this amount is received.

- A debit or withdrawal more than the nominated amount

You can select a withdrawal amount, and you will be alerted when any deposit over this amount is received.

- Account balance at Close of Business on a regular frequency

You can select the frequency in which you are notified of your balance (daily, weekly, fortnightly, monthly, quarterly) and when the notifications will begin.

- Internet Banking Login

You will be notified your internet banking details are used to login. This can help protect you against unauthorised account access.

- New message received

You will be notified that you have received a secure message within internet banking.

Both Internet Banking and the MOVE Bank App offer security features, including One-Time Passwords (OTPs), PINs, and Face ID login options. To further enhance your security, we recommend using a password manager, which helps generate strong, complex, and unique passwords for all your online accounts. Additionally, you can set up Alerts to receive notifications for Internet Banking logins or transactions, keeping you informed and alert to any unauthorised access.

Please ensure any scheduled payments have been added to Internet Banking prior to 24th of March 2025 to ensure a smooth transition. Our Member Experience Team are available to assist with this process.

If you have any technological difficulties, please refer to our Internet Banking Hub or give our Member Experience Team a call during business hours.

MOVE Bank is dedicated to offering transparent and competitive banking services to our Members. There are no fees for self-service banking in Internet Banking and the MOVE Bank app. Please refer to our Fees & Charges for further information.

BANKING & SAVINGS

CAR & PERSONAL LOANS

TOOLS & SUPPORT

CONTACT US

Privacy | Conditions of Use | Contact Us

Railways Credit Union Limited trading as MOVE Bank | ABN 91 087 651 090 | AFSL/Australian credit licence 234 536 | BSB 724 100 | Swift code WPACAU2S