Buying your first home

We have a range of home loans to help you achieve this exciting milestone

- Home Page

- Our Home Loans

- Buying your first home

Quick links

Jump straight to the information you need

![]()

How much can I borrow?

![]()

Chat to a lending specialist

![]()

I'm ready to apply

.

We're with you every step of the way

We appreciate that buying your first home can be feel a little daunting. At MOVE, our friendly team of lending specialists are here to help guide you through your home loan journey and get you into your new home sooner.

For more helpful information and tips on getting your first home loan, view our FAQs section at the bottom of this page.

.

Check out our Owner-Occupier home loans

To be eligible for this rate, a credit of $1500 a month must be deposited into a MOVE Bank transaction account.

- Borrow up to 95% (with LMI)

- No ongoing monthly or annual fees

- Redraw available

- Owner Occupied <80% LVR 5.39%p.a. Interest rate

-

5.44%p.a.Comparison rate

To be eligible for this rate, a credit of $1500 a month must be deposited into a MOVE Bank transaction account. A fixed rate loan designed to offer excellent features.

- 1, 2, 3 & 5 year fixed options

- Borrow up to 95% (with LMI)

- To be eligible for this rate, a credit of $1500 a month must be deposited into a MOVE Bank transaction account.

- Owner Occupied 2 Year Fixed 5.49%p.a. Interest rate

-

5.46%p.a.Comparison rate

A variable loan with 100% offset and no ongoing fees.

- Borrow up to 95% (with LMI)

- 100% offset account

- No ongoing monthly or annual fees

- Owner Occupied <80% LVR 5.59%p.a. Interest rate

-

5.64%p.a.Comparison rate

A fixed rate loan with a 100% offset account.

- 1, 2, 3 & 5 year fixed options

- 100% Offset account

- Owner Occupied 2 Year Fixed 5.69%p.a. Interest rate

-

5.66%p.a.Comparison rate

- Everyday Variable Home Loan

- Everyday Fixed Home Loan

- Offset Variable Home Loan

- Offset Fixed Home Loan

Product Features:

Home Loans |

|

|---|---|

| Minimum Loan Amount : | $100,000 |

| Maximum Loan Amount : | $3,000,000 |

| Maximum Loan to Valuation Ratio (LVR) : | 80% for Principal & Interest or 80% for Interest Only |

| Maximum LVR with LMI : | 95% for Owner-Occupier or 90% for Investment |

| Maximum Loan Term : | 30 years |

| Interest Type : | Variable |

| Repayment Type : | Principal & Interest or Interest Only |

| Interest Only Available : | Yes, Interest Only available for Owner-Occupier construction loans (max 12 months) or Investment loans (max 5 years) |

| Repayment Frequency : | Weekly, Fortnightly or Monthly |

| Offset Account : | No |

| Additional Repayments Accepted : | Yes |

| Redraw Facility : | Yes |

| Establishment Fee : | $600 |

| Annual Package Fee : | $0 |

| Discharge Fee : | $350 |

| Available for Bridging : | No |

| Split Fee : | $50 |

| Available for Construction : | Yes |

Product Features:

Home Loans |

|

|---|---|

| Minimum Loan Amount : | $100,000 |

| Maximum Loan Amount : | $3,000,000 |

| Maximum Loan to Valuation Ratio (LVR) : | 80% for P&I loans or 80% for IO loans |

| Maximum LVR with LMI : | 95% for Owner-Occupied Loans and 90% for Investment |

| Maximum Loan Term : | 30 years |

| Interest Type : | Fixed - 1, 2, 3 and 5 years |

| Repayment Type : | Principal and Interest. Interest Only available for investment loans |

| Interest Only Available : | Yes, Interest Only available for investment loans only |

| Repayment Frequency : | Monthly |

| Offset Account : | No |

| Additional Repayments Accepted : | Yes |

| Redraw Facility : | Yes |

| Establishment Fee : | $600 |

| Annual Package Fee : | $0 |

| Rate Lock Option : | Yes |

| Discharge Fee : | $350 |

| Available for Bridging : | No |

| Split Fee : | $50 |

| Available for Construction : | Yes |

Product Features:

Home Loans |

|

|---|---|

| Minimum Loan Amount : | $100,000 |

| Maximum Loan Amount : | $3,000,000 |

| Maximum Loan to Valuation Ratio (LVR) : | 80% for Principal & Interest or 80% for Interest Only |

| Maximum LVR with LMI : | 95% for Owner-Occupier or 90% for Investment |

| Maximum Loan Term : | 30 |

| Interest Type : | Variable |

| Repayment Type : | Principal & Interest or Interest Only |

| Interest Only Available : | Yes, Interest Only available for Owner-Occupier construction loans (max 12 months) or Investment loans (max 5 years) |

| Repayment Frequency : | Weekly, Fortnightly or Monthly |

| Offset Account : | Yes |

| Additional Repayments Accepted : | Yes |

| Redraw Facility : | Yes |

| Establishment Fee : | $600 |

| Discharge Fee : | $350 |

| Available for Bridging : | No |

| Split Fee : | $50 |

| Available for Construction : | Yes |

Product Features:

Home Loans |

|

|---|---|

| Minimum Loan Amount : | $100,000 |

| Maximum Loan Amount : | $3,000,000 |

| Maximum Loan to Valuation Ratio (LVR) : | 80% for P&I loans or 80% for IO loans |

| Maximum LVR with LMI : | 95% for Owner-Occupied Loans and 90% for Investment |

| Maximum Loan Term : | 30 years |

| Interest Type : | Fixed - 1, 2, 3 and 5 years |

| Repayment Type : | Principal and Interest. Interest Only available for investment loans |

| Interest Only Available : | Yes, Interest Only available for investment loans only |

| Repayment Frequency : | Monthly |

| Offset Account : | Yes |

| Additional Repayments Accepted : | Yes |

| Redraw Facility : | Yes |

| Establishment Fee : | $600 |

| Rate Lock Option : | Yes |

| Discharge Fee : | $350 |

| Available for Bridging : | No |

| Split Fee : | $50 |

| Available for Construction : | No |

We're here to make banking the way it should be.

Real conversations

Know that you can always speak to someone who will provide you with honest and genuine support.

Value for money

Our products are designed to be simple, flexible and offer exceptional value.

Member-focused

We are driven by our members and 100% of our profits are used to benefit you, not shareholders.

Other calculators

Home Insurance

- Choice of 3 cover options

- Pay fortnightly or monthly at no extra cost

- Lodge claims 24/7

Ready to make the move?

We look forward to helping you through each step of your loan journey

![]()

Speak with our friendly lending specialists

![]()

Calculate your borrowing power

![]() Submit your application online

Submit your application online

(takes 10-15mins)

Key Terms Explained

To help you navigate the various terms and jargon that gets thrown around in the finance industry, we’ve listed some of the most commonly used below.

Application fee: An application fee (also called an establishment fee) is a once-off fee which is charged by a financial institution for setting up your home loan.

Arrears: Money that is owed.

Body Corporate: A body corporate is a legal entity made up of all of the owners in a community titles scheme (i.e. unit block, townhouse, high-rise apartment etc.). The body corpoate looks after the administrative and up-keep of the communal areas.

Building Insurance: Building insurance is a policy which covers any damage to the structural integrity of your home (i.e. damage from cyclone, flood, fire etc.).

Certificate of Currency: A certificate of currency (also known as an insurance certificate), is a certificate provided by your insurer which indicates that a property is insured.

Contents Insurance: Contents insurance is a policy which covers the damage or loss of your possessions while they’re located in your home.

Comparison Rate: A comparison rate is a tool to help you identify the true cost of a loan. It is a rate that includes both the interest rate and the fees and charges relating to a loan, combined into a single percentage figure.

Contract of Sale: Once you’ve found the property you like, you can make an offer to purchase it. The agent will formalise your offer in the form of a contract for you to sign. The contract sets out the amount you are offering for the property, the details of when you will pay your deposit and the date of settlement.

Conveyancer: A person qualified to handle the contract of sale and will act for you in the selling or buying of property.

Credit History: Credit history is a record of an individual’s borrowing history which is compiled into a credit report. The credit report is a compilation of a number of places including banks, collection agencies, governments, and utilities companies.

Default: When a borrower is 90 days or more behind in making a repayment on their loan.

Deposit: A deposit refers to the initial funds used as an up-front payment to a financial institution to purchase a house.

Equity: The difference between the amount you owe on your home loan and the current value of your property.

FHOG: The First Home Owner Grant (FHOG) is a one-off grant payable to first home owners to offset the effect of GST on home ownership.

Fixed Rate: A fixed rate home loan means that you lock in an interest rate for a set period of time (usually 1, 3 or 5 years). At the end of the fixed rate term, the loan will usually change to the standard variable rate offered by the lender.

Guarantor: A guarantor is someone (usually a parent) who uses their property (or the equity in their property) as security, allowing a borrower to reduce the overall deposit required and avoid paying LMI.

Home Insurance: Home insurance refers to both building and contents insurance (these insurances are often on the one policy).

Honeymoon rates: A honeymoon rate (sometimes referred to as an introductory rate) is an interest rate which is offered for a preliminary period of your mortgage term. Once the period is over, the rate reverts back to the standard variable rate which is offered by the lender (often significantly higher than the honeymoon rate).

LMI: Lenders mortgage insurance (LMI) is a type of insurance which covers your financial institution if you default on your home loan. It also helps borrowers to get into the property market with a deposit of less than 20%.

LVR: Loan to Valuation Ratio (LVR) is a percentage figure which represents the amount you are borrowing against the value of the property used to secure the loan.

Mortgage term: A mortgage term sets out the length of time that you agree to pay off your home loan- usually 25-30 years.

Offset Account: A mortgage offset is a transactional or savings account which is linked to your home loan. The money that you put in this account will reduce the amount of interest payable on your mortgage.

Pre-approval: A pre-approval locks-in the amount that you can borrow, subject to certain conditions and for a set period of time (usually 6 months). Getting a pre-approval for your first home loan will mean that you will know exactly how much you can spend and will assist you in negotiating prices and making offers on a property.

Redraw facility: Redraw facilities allow you to withdraw money you’ve already contributed to your home loan. Essentially the amount you can redraw is made up of whatever extra repayments you’ve made on your loan during its lifetime.

Settlement: Settlement describes the meeting between your solicitor/conveyancer and your lender, where the property and funds legally change hands.

Serviceability: Serviceability is a term often used by financial institutions which indicates a borrower’s ability to meet loan repayments. Serviceability is calculated based on the loan amount, the borrower’s income, expenses and other commitments.

Stamp Duty: Stamp duty is a tax imposed on legal documents usually in the transfer of assets or property.

Valuation: An assessment completed by a registered valuer which indicates how much a property is worth.

Variable Rate: A variable rate home loan means that your interest rate will move with the changes in market interest rates. This means that your interest rate could rise and fall over the life of your loan, which may affect your repayments.

1. Know how much you can borrow

Once you’ve made the decision to buy a home it’s tempting to start browsing property websites like realestate.com.au in search of your dream home. Our advice? STOP RIGHT THERE!

Don’t even think about looking at property websites until you’ve spoken to your lender and had a conversation about how much you are able to borrow. An even smarter idea is to get pre-approved for your home loan. A pre-approval locks-in the amount you can borrow, subject to certain conditions and for a set period of time (usually three months).

Getting pre-approved for your loan allows you to know in advance how much you can afford to spend on your home. That means when you start looking for a home you’ll be shopping in the right market – and makes it less likely you’ll fall in love with a property that’s way out of your price range.

It also means that when you do find the right property you can confidently make an offer, knowing that your finance is sorted. This gives you a distinct advantage over other buyers who haven’t been approved for a loan.

2. Know the real costs

Finding a property at the right price is important – but the real cost of buying a home is more than just the actual sale price of the property.

Depending on how much you’ve managed to save for your deposit, lenders mortgage insurance (LMI) could be one of your biggest purchasing costs.

You may have heard that you should aim to have a 20% deposit before you buy. This is because if you borrow more than 80% of the purchase price you’ll have to pay LMI, which covers your financial institution if you default on your home loan.

While having less than a 20% deposit may allow you to buy your first home sooner it can also add several thousand dollars to your loan. If this applies to you make sure you ask your lender to give you an estimate of what the LMI is likely to be so you can take it into consideration

Other purchasing expenses you’ll need to take into account include…

- Home loan application fees

- Stamp Duty – work out how much your stamp duty will cost with our stamp duty calculator.

- Legal fees

- Mortgage registration fee

- Building and pest inspections

- Moving costs

- Insurance – this is a condition of loan settlement. Did you know that you can pay your insurance fortnightly at no extra cost when you purchase your insurance through MOVE Bank? Click here to get a quote

3. Know how to manage your finances

While it sounds simple, creating a budget is one thing which is seriously underrated. To begin your budget plan it is important to know exactly how much money you have coming IN, versus how much you have going OUT in the form of financial commitments, major bills and living expenses.

Living Expenses

One thing which can be easily forgotten when creating a budget is to factor in your living expenses- and it pays to be realistic! If you know that you like to head to the movies every Tuesday or out to brunch on a Sunday, make sure you factor this in. There is no point creating a super strict budget which isn’t realistic as there is more of a chance you will ditch the budget and dip into your deposit savings.

Property Expenses

When working out your budget it is essential to factor in the new costs of being a homeowner. As a first home-buyer rates bills and even water bills might seem completely foreign to you.

Rates are one of those bills which will appear in the mail on a quarterly basis and are calculated for each property based on land valuations and rating categories. Other levies and waste management charges will also be included. When looking at the 2015/2016 Brisbane City Council statistics, average rates bill in the Brisbane area can cost anywhere between $700 and $2600 depending on the suburb in which you live 1. In addition to your rates, it’s likely you’ll also need to spend some money each year on routine maintenance to your property so make sure you include this in your calculations.

Home Loan Repayments

When working out how much you should start saving it is important to factor in what your future mortgage repayments might look like. You can use the MOVE Banks home loan repayment calculator to work out how much you should start putting away every fortnight, and if you can afford any extra it is a good idea to put this in too! Having these funds in a high-interest saver will mean you can start earning extra dollars off your deposit nest egg and will help you reach your deposit goals a little bit quicker. When it comes time to buy, showing a mortgage lender a solid savings history will really boost the strength of your home loan application.

4. Know your lending specialist

Your home-loan is likely to be the greatest financial commitment you ever make. With a decision this important, you need someone in your corner you can turn to for advice and provide answers to the hundreds of questions that will be racing through your mind.

That’s why it’s important to get to know your lending specialist right at the beginning of your home-buying journey. The right lending specialist will be able to give you advice on everything from how to maximise your deposit savings to which loan type is right for your individual situation

MOVE Banks lending specialists are committed to helping you every step of the way and are more than happy to touch base throughout the savings process. You can think of them as your home loan guru!

The majority of home loans fall into one of three categories: fixed rate loans, variable loans and split loans. Each type of loan can provide you with specific benefits – but how do you know which one is right for you? To help you decide, we’ve broken each loan type down into its pros and cons so you can get a better idea of which option might suit you best. We’ve done the hard work for you!

So if you’re in the dark about which option is best for you, look no further- we’ve got you covered!

Fixed

A fixed rate home loan means that you lock in an interest rate for a set period of time (usually 1, 2, 3 or 5 years). At the end of the fixed rate term, the loan will usually change to the standard variable rate offered by the lender.

While fixed-rate home loans ensure that fluctuating interest rate rises do not affect you, this also means that rate drops won’t apply to you. Fixed rate home loans can also restrict features such as redraw facilities, extra repayments and break fees often apply.

|

Pros:

|

Cons:

|

Best for: Fixed rate loans are great for people that want the security of knowing their repayments aren’t going to change. So if you’re on a tight budget a fixed rate loan can really help with managing your cash flow.

Variable

If you decide not to fix your home loan, your interest rate will move with the changes in market interest rates. This means that your interest rate could rise and fall over the life of your loan, which may affect your repayments. Variable rate home loans are generally more flexible with your repayments, redraw facilities and offset options.

|

Pros:

|

Cons:

|

Best for: Variable rate loans are great for people that want the flexibility of paying extra repayments into their home loan. So if you’re looking to pay off your home loan as quickly as possible, a variable rate home loan will offer you the flexibility you need, with all the added benefits of an offset and redraw facilities.

A variable rate option is also great for people who are planning on ‘flipping’ their property- in other words, people who buy property to sell it shortly after, because there are no exit or break fees.

Split

You can also take advantage of fixed and variable options by splitting your loan, meaning that one part is fixed and the other part is variable. This can offer you the best of worlds, security from interest rate rises and the benefits of interest rate drops.

|

Pros:

|

Cons:

|

Best for: Splitting your home loan into both fixed and variable portions are great for people who want the security of knowing that their repayments won’t change on the fixed portion and the flexibility of knowing that they can pay extra repayments into the variable portion. So if you want the best of both worlds, splitting your home loan might be the option for you.

While it sounds simple, finding a good rate is one of the many things to consider when choosing a home loan.

Be sure to check out and compare these features of each home loan you come across.

• Do they offer an offset facility?

• Do they allow you to make extra repayments?

• Do they allow you to make unlimited redraws?

• Do they charge any ongoing fees or early payout fees?

When it comes to managing your home loan, an offset account can be a powerful tool if used correctly.

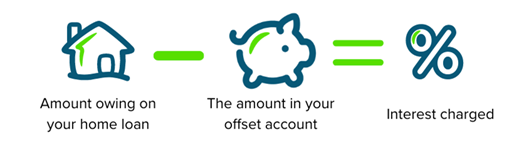

How does it work?

The balance in the offset account is subtracted from the outstanding mortgage balance, reducing the amount on which interest is calculated. As a result, members can effectively lower their interest expenses and potentially shorten the loan term.

Interest savings:

An offset account is a transaction account linked to your home loan. The balance in this account is offset against your outstanding mortgage balance, reducing the amount on which interest is charged. By maintaining a higher balance in the offset account, members can save on interest costs over the life of the loan.

Flexibility and accessibility:

Offset accounts provide members with easy access to their funds. It functions like a regular transaction account, allowing you to deposit and withdraw money as needed. This flexibility ensures that your funds are readily available for day-to-day expenses while still offsetting your home loan interest.

Reduced interest payments:

By utilising an offset account effectively, members can decrease the amount of interest they pay on their home loan. The interest is calculated on the outstanding loan balance minus the balance in the offset account. This means that the more money you keep in the offset account, the less interest you'll be charged.

Potential for faster loan repayment:

With an offset account, members can accelerate their home loan repayment. By maintaining a higher balance in the offset account, the interest savings can be substantial, enabling you to pay off your loan sooner than the original loan term.

Potential Tax advantages:

The interest earned in a regular savings account is generally taxable. However, the interest saved through an offset account is not considered income, providing potential tax advantages for members. This can be particularly beneficial for individuals in higher tax brackets.

Easy money management:

An offset account can be a valuable tool for members looking to manage their finances effectively. It allows you to pool your income, savings, and expenses in a single account. By consolidating your funds, you can better monitor your financial position, reduce interest expenses, and potentially pay off your loan faster.

Remember, it's important to consult with a financial advisor or an accountant to determine if an offset account is suitable for your specific circumstances and financial goals.

Your home-loan is likely to be the greatest financial commitment you ever make. With a decision this important, you need someone in your corner you can turn to for advice and provide answers to the hundreds of questions that will be racing through your mind.

That’s why it’s important to get to know your lending specialist right at the beginning of your home-buying journey. A good lending specialist will become your home buying guru; they will ask you questions such as your income and living expenses to estimate the maximum dollar amount you can borrow. They will also be able to give you advice on everything from how to maximise your deposit savings to which loan type is right for your individual situation.

MOVE Bank’s lending specialists are committed to helping you every step of the way and are more than happy to touch base throughout the savings process. You can think of them as your home loan guru!

Related Articles

The First Home Buyer's Guide

Purchasing a new property can be challenging even for seasoned home-owners – but for a first home-buyer, this process can be 100 times more daunting. Here are some of the most common questions answered for you...

5 tips for finding a property in a competitive market

2023 saw property prices continue to rise despite consistent interest rate rises and high inflation. As a result, the prospect of securing a property has become even more challenging. Here are our top 5 tips to help you get into the market sooner.

Ultimate Moving Hacks: How to Save Money and Spend Smart

Moving house, whether you're renting or buying, upsizing or downsizing, or relocating for the first or fiftieth time, can be an exciting yet costly process. To help you navigate the move without blowing your budget, the team at MOVE Bank has compiled our top money-saving moving hacks. Discover where to cut costs and where it pays to invest when setting up your new home.

Four things every first home-buyer should know

Purchasing a new property can be challenging even for seasoned home-owners. So here are four things every first home-buyer should know...

Footnotes:

- 1 Comparison rate is based on a secured loan of $150,000 for a term of 25 years. WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate. Fees and charges apply. Rates quoted are correct as stated and are subject to change without further notice. All rates quoted are per annum. All applications are subject to MOVE’s standard credit assessment and eligibility criteria.

- 2 Reverts to Owner Occupied or Investment Everyday Home Loan Variable <80% Rate. Minimum loan amount $100,000.

- 3 Reverts to Owner Occupied or Investment Offset Home Loan Variable <80% Rate. Minimum loan amount $100,000.

- 4 Alternate interest rate and LVR conditions apply to Interest Only loans. LMI may be required for loans over 80% LVR. Details are available upon application.

- 5 Establishment fee includes one standard valuation up to $205.

- 6 The split fee is charged for each split on the application.

- 7 Additional repayments can be made up to a limit of $10,000 per fixed rate term

BANKING & SAVINGS

CAR & PERSONAL LOANS

TOOLS & SUPPORT

CONTACT US

Privacy | Conditions of Use | Contact Us

MoveBank Ltd | ABN 91 087 651 090 | AFSL/Australian credit licence 234 536 | BSB 724 100 | Swift code WPACAU2S