About MOVE Bank

Real people, real connections - The way banking should be

- Home Page

- About Us

- About MOVE Bank

Real People Real Banking

MOVE Bank is driven by our members and 100% of our profits are used to benefit you.

Our boutique size enables us to provide a superior level of personalised service, while large enough to offer all the services you expect from your bank.

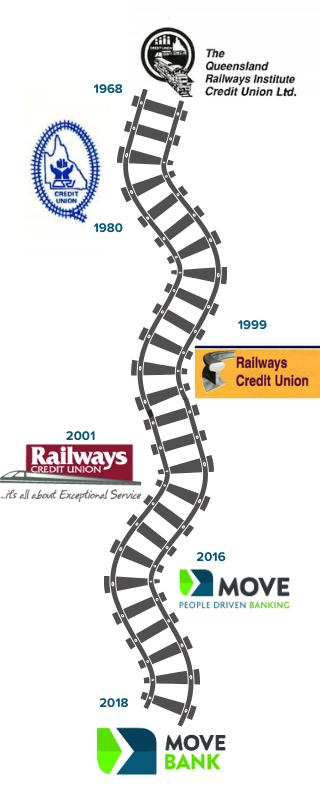

Since our beginnings as Railways Credit Union in 1968 a lot of things have changed, however our commitment to providing exceptional service and competitive financial products to our members hasn't.

Currently, MOVE Bank has more than $750 million in assets under management. As an approved deposit-taking institutions, deposits with MOVE Bank are guaranteed by the Government's Financial Claims Scheme up to $250,000 per depositor.

View our annual report.

Our History

Railways Credit Union was established in 1968 to help railway workers and their families build stable financial futures and achieve their goals. Since then we’ve been dedicated to providing our members with high quality, competitive financial products and exceptional service.

In March 2016 we became MOVE People Driven Banking, to reflect our commitment to serving the broader transport and logistics industry at a national level. This change allowed us to continue to build on our past success and to develop valuable new transport industry alliances.

Becoming MOVE Bank

On 7 May 2018 we made the exciting transition to MOVE Bank. This change came about in response to legislative changes that removed previous restrictions on the use of the word bank.

The change provided us with an unprecedented opportunity to tell people clearly and simply what we do - which is provide quality, competitive banking products and services to members of the rail, transport and logistics industries and their families.

Committed to mutuality

While our name may have changed, our commitment to mutuality remains as strong as ever. MOVE Bank is 100% customer-owned, and is committed to putting the needs of members first in everything we do.

As an approved deposit-taking institution (ADI) MOVE Bank is covered by the Financial Claims Scheme. This means that deposits held with MOVE Bank are guaranteed by the Government up to $250,000 per depositor. More information about the FCS is available on our website on the Government Guarantee page.

Scott Riedel (Chair)

Tim Staley

Bill Armagnacq

Sarah Dixon

Marcus Salouk

Rachel Adair

Mike Currie

Chief Executive Officer

Kathy Beavan

Chief Financial Officer

Taryn Pontifex

Chief Operating Officer

Craig Nichols

Chief Risk Officer

Trevor McNamara

Chief Digital Officer

Sascha Jovanoski

Senior Lending Specialist

Scott Uren

Lending Consultant

Broker Lending Team

Julie O'Regan

Broker Relationship Specialist

Namita Bansal

Lending Specialist

Max Campbell

Lending Consultant

Brooke Newlove

Broker Relationship Specialist

Jeff Urquhart

Senior Manager Service & Operations

Elizabeth Goodchild

Personal Banking Consultant

Belinda Bass

Banking Operations Team Leader

Maree Cain

Service and Operations Manager

Chayanika Choubey

Personal Banking Consultant

Joe Gavarra

Banking Operations Officer

Phebe Anderson

Personal Banking Team Leader

Aim Yuvienco

Personal Banking Consultant

Bethany Duxbury-Jones

Banking Operations Officer

Nigel Sleeman

Personal Banking Consultant

Kharen de Guzman

Personal Banking Consultant

Zanna Blackburn

Banking Operations Officer

Kellie Towerton

Credit & Lending Operations Manager

Teressa Sellin

Lending Operations Officer

Michelle Capek

Credit Support Specialist

Teri Hawkins

Credit Team Leader

Marcel Coopman

Senior Loan Assessor

Mel Cross

Senior Lending Operations Officer

Jonathon Jackson

Senior Loan Assessor

Tracy Morris

Lending Operations Officer

Joe Poulter

Credit Support Specialist

Daniel Salmon

Product and Data Analytics Lead

Brett Pola

Applications Support Officer

Kritika Tagra

Applications and Delivery Lead

Paul Stevens

Technology and Cyber Lead

James Robertson

Technical Support Officer

Bryan Jones

Finance Manager

Aaron McAuley

Finance Officer

100% Customer Owned

As a MOVE Bank member you are one of 4 million Australians who enjoy the benefits of customer owned banking 1. This means you have the peace of mind of knowing that 100% of our profits are used to benefit you – by providing you with award winning products, competitive rates, and an exceptional member experience.

MOVE Bank is also a signatory to the Customer Owned Banking Code of Practice. This is an expression of the importance we place on improving the financial well being of our members.

The Code includes the following promises:

We will comply with this Code in our dealings with you.

We will incorporate this Code by reference in our written Terms and Conditions for products and facilities to which the Code applies.

We will do this within twelve months of agreeing to adopt this Code (or, if later, within twelve months of the commencement date of this Code).

Our Code obligations include the following key promises that we make to you as our customers and owners.

Key Promises

- We will deliver banking services in the interests of our customers.

- We will obey the law.

- We will not mislead or deceive.

- We will act honestly and fairly.

- We will offer products and services that are fit for general purpose.

- We will deliver services with reasonable care and skill.

- We will contribute to our community.

For more information click here to read the Customer Owned Banking Code of Practice

Ready to make the MOVE

Wanting to work for a bank that values real connections? MOVE Bank is here to make banking the way it should be.

MOVE Bank has an outstanding reputation for exceptional member service. As a mutual bank, our members are at the heart of everything we do, and meeting their expectations is a defining characteristic of our customer service.

Why choose us?

1For more information click here to read the Customer Owned Banking Code of Practice

BANKING & SAVINGS

CAR & PERSONAL LOANS

TOOLS & SUPPORT

CONTACT US

Privacy | Conditions of Use | Contact Us

MoveBank Ltd | ABN 91 087 651 090 | AFSL/Australian credit licence 234 536 | BSB 724 100 | Swift code WPACAU2S